Boat insurance can cost as low as $100 to upwards of several thousand a year. On average, the price of boat insurance annually is between $200 and $500. It all depends on the value of the boat and the condition of it.

When selecting boat insurance, it’s essential to consider factors beyond cost, like coverage limits, deductibles, and reputation for claim handling.

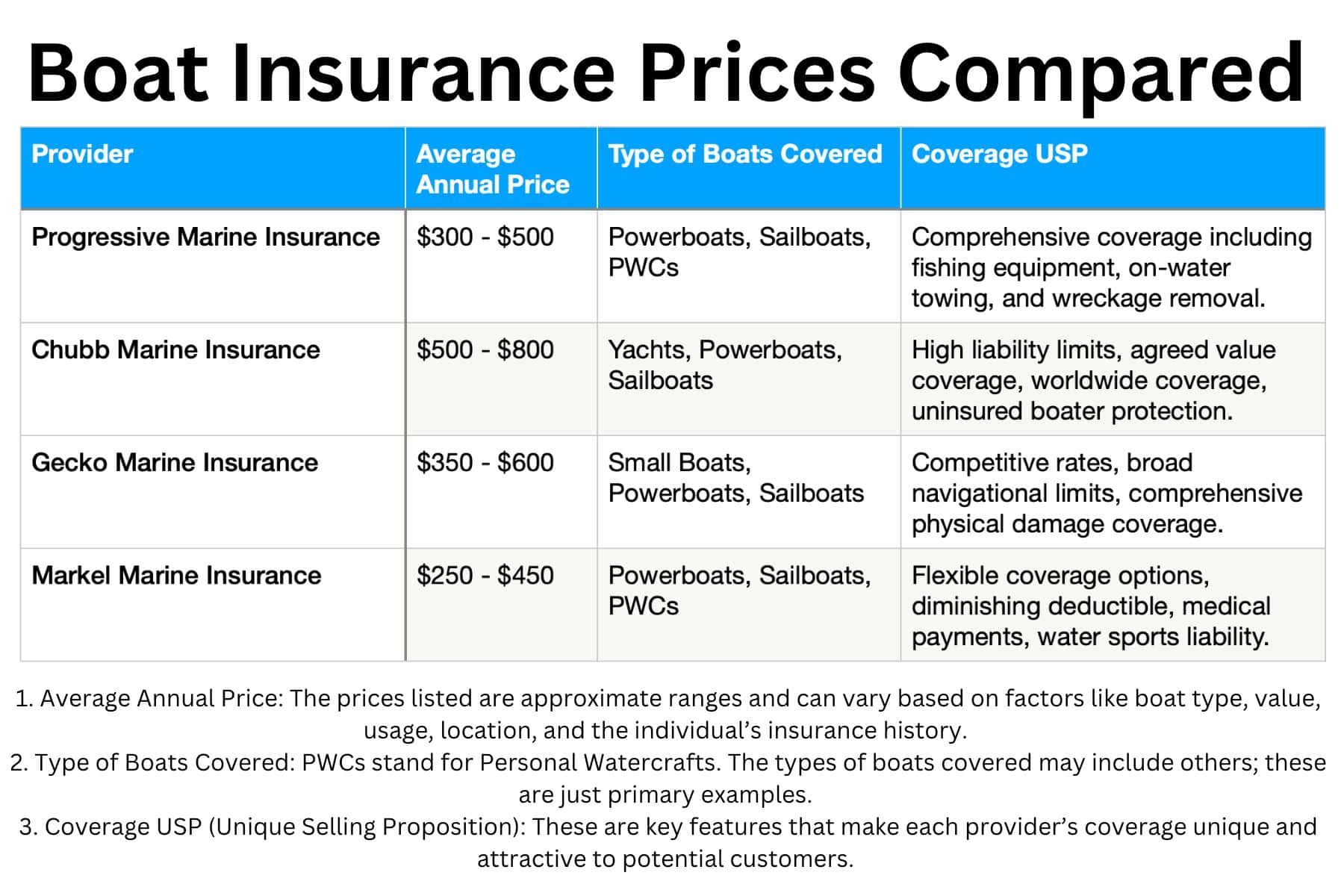

We have made a table with these insurance providers below. We’ve added prices and indicated which provider specializes in the specific type of boat. Click here to jump to it.

The Top 5 Boat Insurance in 2025

-

1

Most Affordable Options: Progressive Marine Insurance -

2

Luxury boat coverage: Chubb Marine Insurance -

3

Customizable with Add-ons: Geico Marine Insurance -

4

Ideal for Smaller Yachts: Markel Marine Insurance

All the Boat Insurance We reviewed:

Where to buy Progressive Marine Insurance:

Progressive.com

Progressive insures a wide range of boats under 50 feet and valued at or below $500,000, offering various discounts for policy bundling, safety courses, and being the original boat owner.

Progressive covers boats up to 50 feet in length and under $500,000 in value. It is known for competitive rates and ten different insurance discounts, including full payment, safety course completion, and responsive service.

Available add-ons include replacement cost coverage, hurricane haul-out, and Sign & Glide for emergency services like towing and jump starts.

Things we like:

-

Affordable towing coverage

-

Ten discount options for boat owners

Things we don't like:

-

Restrictions based on boat age, value, and material

Where to buy Progressive Marine Insurance:

Progressive.com

Where to buy Chubb Marine Insurance:

Chubb.com

Chubb specializes in insuring high-value items and offers boat insurance for pleasure boats. Their coverage is designed for high-net-worth clients, encompassing additional equipment like scuba gear, water skis, and premium coolers.

Chubb is optimal for insuring larger, more expensive boats or yachts. It provides specialized coverage for high-value boats up to 35 feet, ideal for owners with costly onboard items. Unique services for yacht owners include complimentary crew background checks, travel briefings, and discounted security services.

Things we like:

-

Insures a range of watercraft up to 35 feet

Things we don't like:

-

Not suitable for those seeking basic policies

Where to buy Chubb Marine Insurance:

Chubb.com

Where to buy Geico Marine Insurance:

Geico.com

Geico collaborates with BoatUS to provide marine insurance in all 50 U.S. states. Their standard offerings include agreed hull value, actual cash value, and liability-only policies.

One reason why they rank highly in customer satisfaction is because of their service and the customizable add-ons they offer.

They’ve partnered up with BoatUS to provide an à la carte range of marine insurance policies. These policies can also include discounts for boating safety courses and additional options like towing services, reducing deductibles, and fishing gear coverage.

Things we like:

-

Comprehensive coverage options and extra features

-

Nationwide availability

Things we don't like:

-

Limited discounts featured online

Where to buy Geico Marine Insurance:

Geico.com

Where to buy Markel Marine Insurance:

Markelinsurance.com

Markel is noted for insuring luxury boats, offering extensive coverage for yachts, including theft protection, wreckage removal, and emergency towing. Optional coverages include tournament fee refunds and boat lift insurance.

Markel provides specialized insurance for boats and other unique items, particularly suitable for fishing enthusiasts with coverage for tournament fees and fishing equipment. Markel also offers a range of discounts and specific policies for personal watercraft and yachts, as well as commercial policies for charter or excursion boats.

Things we like:

-

Specialized fishing coverage, including equipment and tournament costs

Things we don't like:

-

Limited bundling options due to fewer policy types

Where to buy Markel Marine Insurance:

Markelinsurance.com

Best Boat Insurance in the U.S. for Different Price Ranges

In the U.S., the best boat insurance varies depending on the policy and the boat. Some providers do better at smaller boats than others, which offer better policies on larger yachts, for example. See the comparison table below.

Budget-Friendly: Progressive is a top choice for boaters on a budget. They offer competitive rates and a range of discounts, like bundling home and auto policies. Despite being affordable, Progressive doesn’t skimp on essential coverages like collision, comprehensive, and liability.

Progressive has proven very popular with boats of different sizes and value. In particular, though, smaller boats like bowriders and ski boats get good coverage from Progressive. Customer services has gotten, generally, decent grades, too.

Mid-Range: State Farm provides an excellent balance between cost and coverage. They offer a variety of coverages, including on-water towing and fuel spill protection. With a vast network of agents, finding local expertise is easy.

Premium: BoatUS has a more comprehensive basket of options for those seeking extensive coverage and specialized services. In partnership with GEICO, the 2nd largest auto insurance firm, they offer an array of policies catering to diverse boating needs.

The bigger motor yachts, with plenty of toys onboard and a lot of value tied up into maintenance, etc., will find some good coverage options with GEICO.

There’s also a host of add-ons that, while the cost extra, provide some pretty smart options tailored to different needs (i.e. climate or region specific coverage like ice damage).

Members also benefit from added perks like marine discounts and free boating safety courses.

Factors That Need Consideration for the Right Insurance

While the aforementioned insurers stand out in their respective price ranges, individual needs might warrant exploring other options. Always compare quotes and read policy specifics before settling.

Boat insurance is paramount for any boat owner, safeguarding both their vessel and peace of mind. The best boat insurance policies should include:

Comprehensive Coverage: This ensures protection from non-collision-related risks like theft, vandalism, fires, or storms.

Collision Damage: This covers repair or replacement costs if your boat collides with another vessel or object.

Bodily Injury Liability: In the event of an accident deemed your fault, this covers the medical expenses of those injured.

Property Damage Liability: This addresses damage to someone else’s property due to your boat.

Uninsured/Underinsured Boater: Should you encounter an accident with an uninsured/underinsured boater, this covers the costs.

How We Compare The Best Insurers:

- Research Reputation: Opt for established insurers with a commendable reputation. Check user reviews and the Better Business Bureau.

- Financial Stability: Insurers should have robust financial backing, ensuring they can handle large claims. A.M. Best is an excellent resource for this.

- Customizability: Policies should be tailorable to fit specific needs. For instance, a sailor might need different coverage than a speedboat.

- Price Quotes: Obtain multiple quotes. While price is a factor, it shouldn’t be the sole deciding factor. Look for the best value, not just the cheapest policy.

- Customer Service: Exceptional customer service is crucial. They should be responsive, helpful, and transparent.

In essence, the ideal boat insurance offers extensive protection at a reasonable price from a reputable, financially stable insurer with stellar customer service.

For info about personal watercraft insurance coverage, read about it here.

Back

Back

Comments